An Unbiased View of Property By Helander Llc

An Unbiased View of Property By Helander Llc

Blog Article

The Definitive Guide to Property By Helander Llc

Table of ContentsThe Single Strategy To Use For Property By Helander LlcThe Main Principles Of Property By Helander Llc 6 Easy Facts About Property By Helander Llc DescribedIndicators on Property By Helander Llc You Should KnowMore About Property By Helander Llc

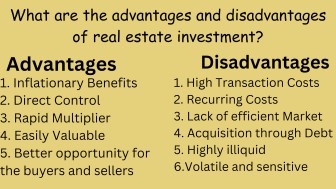

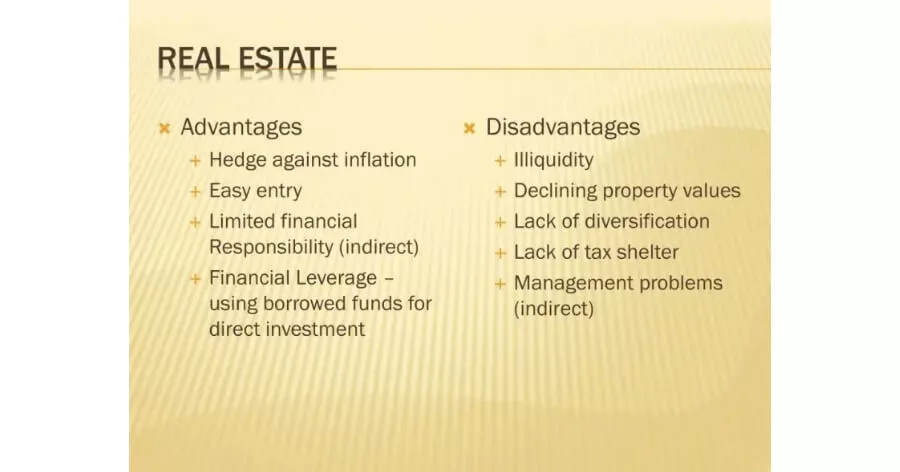

You could require to restore your residential property periodically to make it much more luring to tenants. It calls for up front prices, restoring an entrance hall, updating fixtures or rehabbing old landscaping can make buildings a lot more appealing and aid justify greater leas.Prior to you start a property fund, do your homework. Think of the building's potential appreciation and revenue, the marketplace's efficiency, and the quality of financiers you employ. Having a strong strategy, one that is reflective of your danger resistance, is key to your success. If you wish to chat investment method with a specialist, get to out to our James Moore consultants.

They can assist you make an investment plan that accounts for all potential dangers and advantages. All material supplied in this write-up is for informative objectives only. Matters talked about in this write-up go through change. For current information on this subject please speak to a James Moore specialist. (https://www.kickstarter.com/profile/pbhelanderllc/about). James Moore will not be held liable for any kind of claim, loss, damages or trouble created as an outcome of any kind of details within these web pages or any type of info accessed via this site.

Allow's concentrate on one choice: actual estate. Discover how real estate financial investments can improve your monetary well-being, with a special focus on tax obligation benefits.

What Does Property By Helander Llc Do?

Home mortgage rate of interest reductions can be a benefit to capitalists whose qualified itemized reductions consisting of mortgage rate of interest are higher than the conventional reduction. This tax benefit enables investor to deduct state and neighborhood taxes they pay on financial investment residential or commercial properties from their government income tax obligations. As an example, if you purchased a $750,000 residential or commercial property in San Francisco with an area tax price of.740% of the examined home worth, you're considering $5,550 in regional tax obligations (Sandpoint Idaho land for sale).

The good news is, the real estate tax reduction enables you to write that amount off when you submit federal revenue taxes the list below year. It's worth bearing in mind that this tax reduction goes through certain state and neighborhood limitations and constraints. Ensure to clear up any remaining inquiries with your tax expert.

If you actively take part in property investing, you might have the ability to deduct as much as $25,000 in easy losses1 against your passive revenue. However, this is limited to financial investment residential or commercial properties in which you are presently energetic. If you offer a home due to the fact that it's bringing in losses, you can no much longer utilize this deduction.

Rather of taking a solitary reduction for the year you bought or made substantial renovations to a property, devaluation permits you to disperse the reduction throughout the property's useful life (approximated years of solution for successful earnings generation). Devaluation starts the moment you put a home into solution. In this instance, as quickly as it's ready to be used for rental services.

Property By Helander Llc Fundamentals Explained

Whenever you offer a financial investment residential or commercial property, the internal revenue service wants you to pay funding gains tax obligations on the amount of benefit from the sale. Commonly, resources gains tax obligations are a tired percentage that's deducted from the earnings on sales of funding, like realty. If you bought a home for $500,000 in 2015 and sold it for $750,000 in 2023, you've made a $250,00 revenue.

Nonetheless, there are ways to delight in the advantages of realty investing without needing you to be proactively involved. Here at Canyon View Funding, we comprehend the ins and outs of realty investing. That's because, for over 40 years, our specialists take care of a realty profile that has actually grown to over $1B3 in aggregated value.

When done appropriately, genuine estate is among one of the most popular and lucrative investments with a great deal of potential for success. Real estate spending deals lots of benefits, and investors can delight in a stable earnings flow that may result in financial freedom. You Can Create Easy IncomeBy investing in property, you can create easy income that is nearly tax-free.

The 2-Minute Rule for Property By Helander Llc

By getting a number of rental residential or commercial properties that produce enough revenue to cover your costs, you have the liberty to do what you delight in, instead of investing every one of your time at the workplace. Property investing, when done right, is a stable means to enhance wide range over an amount of time. Amongst the several benefits of property investing is that it can supply cash circulation for retirement.

Unlike securities market investments, realty financial investment does not wildly rise and fall every day. It is a stable investment that gives you with an earnings - realtors sandpoint idaho. You merely collect your ongoing income (recognized as Cash money on Money Return) on a regular my latest blog post basis and want to sell when the cost values considerably and the market is high

Nonetheless, there are ways to appreciate the benefits of actual estate investing without requiring you to be proactively involved. Below at Canyon View Resources, we comprehend the ins and outs of actual estate investing. That's because, for over 40 years, our experts manage a property portfolio that has grown to over $1B3 in aggregated value.

Not known Factual Statements About Property By Helander Llc

By getting a number of rental residential or commercial properties that create enough income to cover your expenses, you have the liberty to do what you take pleasure in, instead of spending all of your time at job. Realty investing, when done right, is a stable way to enhance wide range over a duration of time. Among the several benefits of actual estate investing is that it can supply capital for retired life.

Real Estate Investing Is a Hedge Versus InflationWhile many people are afraid rising cost of living, this is not the case with genuine estate capitalists. Buying properties is an exceptional bush versus rising cost of living. As the cost degree rises, so does the rental revenue you obtain from your residential property and your financial investment's worth.

Unlike securities market financial investments, realty financial investment does not hugely rise and fall daily. It is a stable investment that supplies you with an earnings. You merely collect your continuous income (called Money on Money Return) on a routine basis and want to sell when the price appreciates significantly and the market is high.

Report this page